On line systems including Airbnb and you will Vrbo are making this very popular. Treliant will bring tailored methods to seamlessly add the newest proposed rule to your impacted events’ working processes. Which have total training, streamlined reporting tissues, and continuing assistance, Treliant might help enterprises, as well as lawyer, efficiently apply the fresh revealing requirements and reduce disturbances so you can “organization as ever” process. An alternative Several months are amount of time dependent on the new deal, often four so you can two weeks, where the customer can also be test the house or property and discover whether or not he/she wants to continue with the acquisition of the house. A small commission, the choice Payment, is paid back since the consideration for this several months.

Find your loan terminology, rates, and more! | Las Atlantis casino bonus code

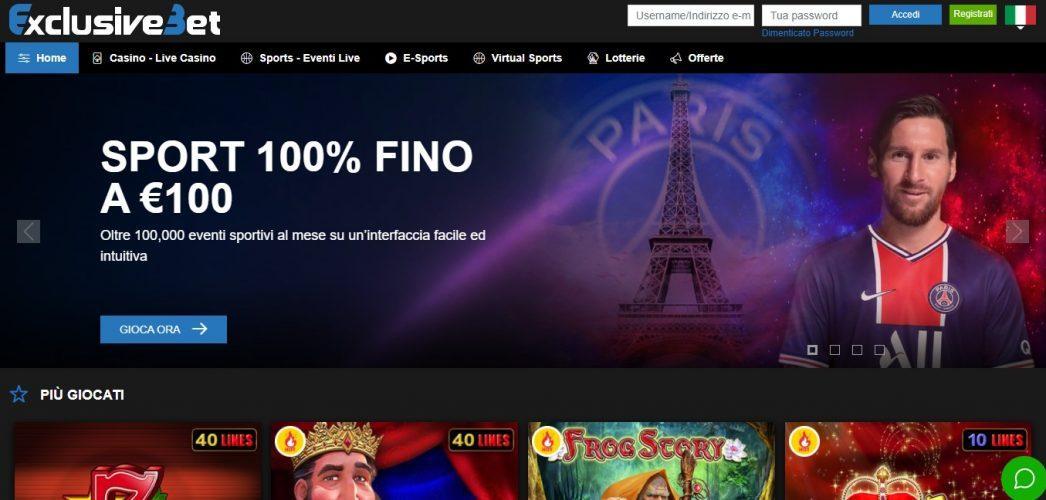

Baccarat is yet another house-founded gambling establishment staple who has along with adult well-known on the web. Players appreciate its simplicity and advanced opportunity, having Banker wagers coming back nearly 99%. Because of its simplicity and you will seemingly an excellent chance, roulette is one of the most preferred on line online casino games. Internet casino slots are provided from the dozens of higher-profile video game makers, along with NetEnt, IGT, Konami, Everi, High 5, Konami, Aristocrat, White-hat Betting, and you will Calm down. Harbors control online casino libraries, spanning in the 90% of their profile.

Are a house REITs a no-brainer?

The word “home-based hard currency” when known inside a house financing, is largely a non-bankable loan to the a financial investment unmarried family home (or duplex). Title domestic hard money is frequently interchanged having “no-doc”, private financing, connection finance, etc… For a residential hard money financing, the newest underwriting decisions are based on the new borrower’s difficult assets. In cases like this the newest home-based investment a home was made use of while the security (through a first home loan) for the exchange. Home-based Difficult currency shuts rapidly (inside as low as three to four months with respect to the circumstances). Buyers is qualify for money no matter what the credit scores or nationality. Most asset-founded individual money loan providers money doesn’t work at personal liabilities otherwise credit history when making a credit decision.

How to Spend money on A home: 5 Simple Strategies for Novices

FinCEN needs the duty so you can file Home Account create generally apply to payment agents, term insurance rates agencies, escrow representatives, and lawyer. The brand new NPRM, although not, designates only 1 reporting individual for your provided reportable transfer, which can be felt like in one of a few means, the newest Revealing Cascade otherwise by written arrangement. You might getting a difficult money-lender, but you’ll require some money. That it likely isn’t probably going to be the initial ways you begin out and make cash in a house, but since you help make your circle, financing, and you will a powerful collection out of selling, you could potentially render these types of connection financing and then make a good rates away from go back.

REITs

After accepted, North Shore Economic is also fund the loan inside as few as 3-5 days to have investment property. Manager occupied fund generally take 2.5 weeks considering the most recent federal legislation that lenders have to adhere to. The new report need to be registered by later on go out out of either (1) the past day of the fresh week pursuing the month in which the brand new reportable import happen; or (2) 30 diary months following date of closing.

By creating an area hustle (or complete-day occupation) from home-based home, you Las Atlantis casino bonus code can create a reputable revenue stream. Even when a house investment is quicker water and can be more time-drinking than organizing your discounts to your stock-exchange, the opportunity of secure couch potato money and you may a diverse investment collection may cause an appealing result the trader. From the GreenBridge Finance, we realize the initial demands and you can possibilities facing domestic a property investors now.

Industrial Paying: Productivity and Risks

However, predict higher upfront will set you back, as well as down payments out of 20-30% or more, and you will make up the increased rates. Even after this type of will set you back, independence within the loan structuring and you will prompt approvals create hard money financing an invaluable device to have house flippers centering on fast investment completions. Regarding the RealPageLocated inside Carrollton, Colorado, an area away from Dallas, RealPage brings for the demand (also called “Software-as-a-Service” or “SaaS”) products to flat organizations and unmarried family renting across the the usa.

Needless to say, this means choosing lower-cost home or distressed characteristics and you will flipping agreements. Moreover it form looking hard-money lenders or other people that can help you push sales due to. This could even apply to home home improvements providing you’re great at finding the money. All-cash requests away from residential a property are considered from the high-risk for money laundering. Our members of the family from the Chicago Term Insurance company has shared details about an alternative laws relevant so you can low-financed domestic a home transfers the spot where the purchaser are an enthusiastic organization or faith.

If the, such as, the house or property business climbs considerably, you can get one to property for a cheap price. You might like to turn around market your rights for that get in order to anybody else. So long as this is an alternative you can take action and you may not something devote brick one claims you have got to purchase at the conclusion of the new lease regardless, then you could well turn a profit.

To include independency and relieve conformity burdens, the past Code integrate a good “cascade” system to determine number one submitting responsibility and you may lets globe pros to specify conformity obligations among on their own. Financial institutions or other institutional loan providers typically have tight credit criteria and this results in of several consumers that have the loan requests denied. Income record and you can borrowing from the bank are generally area of the conditions financial institutions work with. Items including bad credit, and you can previous foreclosures, bankruptcies, financing modifications otherwise short conversion is going to be warning flag to help you a great financial. Move security from a single property to pick various other assets is a common technique for of numerous a home traders. Head tough money fund make it traders to accomplish cash-out refinances right away, enabling the fresh investor in order to capitalize on a new home chance.

With regards to the loan, rates of interest begin only 7% at the time of writing. The design tend to request you to explain whether you are seeking to a buy or refinance mortgage, your local area on your own procedure, the location of the house and also the financing program of interest. For the reason that homebuilders’ costs rise with rising prices, and that need to be passed on to help you people of new home.